#Oracle Flexcube Automation

Explore tagged Tumblr posts

Text

Core Banking System (CBS): Meaning, Working, and Its Importance in Modern Banking

In today’s fast-moving digital economy, customers expect banking to be available anytime, anywhere — whether through a mobile app, ATM, or physical branch. Behind this seamless experience lies a powerful technology called the Core Banking System (CBS). In this blog, we’ll explore what CBS is, how it works, and why it’s the backbone of the banking industry.

What is a Core Banking System?

A Core Banking System (CBS) is a centralized platform used by banks to manage and process all banking operations — such as deposits, loans, transactions, and customer information — in real time across all branches.

CBS stands for Centralized Online Real-time Exchange, enabling customers to access their accounts and perform transactions from any branch or digital channel, not just the one where the account was opened.

How Does CBS Work?

CBS connects various service channels like:

Bank branches

ATMs

Mobile banking apps

Internet banking portals

UPI and IMPS systems

When a customer initiates any request — like transferring funds or checking balance — the CBS immediately validates and processes it, updates the central database, and sends the response back in real time.

Key Features of a Core Banking System

Centralized Database All customer and transaction data is stored in a single, secure database accessible across branches.

Real-Time Processing Transactions are updated instantly, ensuring accurate and up-to-date account information.

Multi-Channel Access Supports various banking channels like mobile, internet, ATM, IVR, and in-branch systems.

Automated Operations Routine banking tasks such as interest calculation, EMI tracking, and report generation are automated.

Regulatory Compliance Built-in tools for RBI reporting, audit logs, and integration with government portals like UIDAI, GSTIN, and CRILC.

Importance of CBS in Banking

Anywhere Banking Customers can access banking services from any branch or digital platform — creating a unified experience.

Improved Customer Service With real-time access to data, banks can offer faster and more accurate services.

Cost Efficiency Reduces operational cost by automating tasks and eliminating data duplication.

Scalability Banks can easily expand services, launch new products, or open new branches without major infrastructure changes.

Enhanced Security CBS platforms offer encrypted transactions, access control, fraud detection, and disaster recovery mechanisms.

Popular Core Banking Software Providers in India

CBS Provider

Banks Using It

Finacle (Infosys)

SBI, Canara Bank, Union Bank

TCS BaNCS

HDFC Bank, Bank of India

Oracle Flexcube

Axis Bank, Kotak Mahindra Bank

Temenos

Global fintechs and digital banks

InfrasoftTech

NBFCs, Co-operative Banks

These providers offer powerful features like cloud-based CBS, API integration, mobile-first interfaces, and AI-powered automation.

CBS and Digital Banking

Modern CBS platforms are now:

Cloud-native for scalability and cost reduction

API-driven for fintech integrations (like UPI, Bharat BillPay, and credit bureaus)

Modular and microservice-based, allowing faster innovation

Compatible with AI, ML, and analytics for personalized banking and fraud prevention

The Future of Core Banking Systems

With evolving customer expectations, CBS is transforming into a smarter and more agile system. Some trends shaping the future include:

AI-powered decision-making for loans and credit scoring

Blockchain-based ledger systems for transparency

Open banking APIs for better third-party integrations

Voice and chatbot banking for customer support

Instant onboarding and KYC using Aadhaar and PAN APIs

Conclusion:

The Core Banking System is the technological core of every modern bank. It not only powers day-to-day operations but also enables innovation, compliance, and customer satisfaction. As digital banking continues to grow, a flexible and future-ready CBS will be the key differentiator for banks and NBFCs alike.

For More information Visit Us:

0 notes

Text

Top Flexcube Core Banking Solutions & Tech Challenges for Banks in 2025

Customization complexity, system integration, and regulatory compliance are major hurdles for financial institutions. That’s why we decided to consult with API Connects—a leading IT services provider in New Zealand—to explore how advanced technologies are overcoming these challenges and optimizing Flexcube core banking solutions.

Key Tech Solutions for Banking: 🔹 Tailored Customization – Customizes Flexcube core banking solutions to meet specific banking needs while maintaining system stability. 🔹 Seamless Integration – Connects Flexcube with digital platforms, payment gateways, and third-party systems for an optimized customer experience. 🔹 Flexcube Upgrades & Migrations – Ensures smooth system updates, preserving customizations and minimizing downtime. 🔹 Regulatory Compliance – Keeps Flexcube in line with evolving global regulations like KYC, AML, and GDPR. 🔹 Scalable Architecture – Designs Flexcube core banking solutions to support growth in transaction volumes and user base. 🔹 Legacy System Integration – Seamlessly connects Flexcube with legacy systems for continued operational efficiency. 🔹 Expert Support – Provides proactive support and liaises with Oracle for rapid issue resolution.

Conclusion: Banks are modernizing core banking systems through tailored Flexcube core banking solutions, ensuring efficiency, compliance, and future scalability. With API Connects' expertise, financial institutions can transform operational challenges into growth opportunities, ensuring a seamless banking experience for all.

Don’t forget to check their most popular services:

Automation Solutions

robotic process automation solutions

machine learning services

core banking solutions

IoT business solutions

data engineering services

DevOps services

mulesoft integration services

ai services

0 notes

Text

What are the learning prerequisites for Oracle Flexcube?

Oracle FLEXCUBE Online Training & Certification Course by ProExcellencyLearn is one of the best core banking products with ProExcellency's expert-led online training. Learn about retail, corporate, and digital banking, as well as how to install, customize, and integrate. Get hands-on experience, best practices, and ready for certification to drive your career forward in the banking industry. Sign up now and enhance your skill in Oracle FLEXCUBE!

What is Oracle Flexcube?

Oracle FLEXCUBE is a core banking technology developed by Oracle Financial Services to help banks and financial institutions streamline their operations. It provides account management, payments, loans, trade finance, treasury, and digital banking services to retail, corporate, and investment banking clients. Oracle FLEXCUBE helps financial institutions drive efficiency, customer experience, and change in response to the evolving banking landscape through robust automation, risk management, regulatory compliance, and API integration.. Its scale-invariant architecture provides smooth digital transformation, rendering it a bank of choice globally.

What are the learning prerequisites for Oracle Flexcube?

Prerequisites for Learning Oracle FLEXCUB

Although Oracle FLEXCUBE training is intended for both freshers and experienced professionals, the following knowledge will prove useful:

Basic Banking Knowledge – Knowledge of banking fundamentals, financial deals, and banking activities.

Database & SQL – Acquaintance with Oracle Database as well as SQL queries can assist in customization and reporting.

ERP & Financial Systems – Familiarity with banking ERP packages or financial management solutions is a plus.

IT & Programming (Optional) – Java, APIs, and integration frameworks knowledge is beneficial for technical positions.

Banking Regulations & Compliance (Optional) – Industry regulation awareness can assist in implementation and compliance management.

Modules of Oracle FLEXCUBE Covered in Training:-

ProExcellency's Oracle FLEXCUBE Online Training includes key modules to enable you to master this core banking solution.

1. Core Banking Operations

Customer Account Management

Deposits & Loans Processing

Payments & Fund Transfers

Interest & Charges Management

2. Retail & Corporate Banking

Retail Banking Services

Corporate Banking Solutions

Trade Finance & Treasury Management

Wealth & Asset Management

3. Digital & Internet Banking

Omni-Channel Banking

Mobile & Internet Banking

Customer Onboarding & Self-Service

4. Risk & Compliance Management

Regulatory Compliance & Reporting

Fraud Identification and Risk Control

AML (Anti-Money Laundering) and KYC (Know Your Customer)

5. Technical & Customization

FLEXCUBE Architecture & Database

APIs & System Integrations

FLEXCUBE Customization & Configuration

Troubleshooting & Support

Who Should I Take Oracle FLEXCUBE Training?

Oracle FLEXCUBE training is suitable for professionals wishing to develop knowledge in core banking solutions. The course is most appropriate for:

Banking & Financial Professionals – Individuals employed in banks, financial institutions, and fintech firms.

IT & Software Professionals – Software developers, system administrators, and IT consultants engaged in banking technology.

Business Analysts & Functional Consultants – Individuals examining and streamlining banking operations.

Database Administrators (DBAs) – Individuals dealing with Oracle databases in banking setups.

Project Managers & Implementation Consultants – Professionals managing FLEXCUBE implementation and integration projects.

Fresh Graduates & Career Switchers – Professionals who want to make a career transition into the banking technology sector with in-demand skills.

Topics Covered in Oracle FLEXCUBE Training:-

ProExcellency's Oracle FLEXCUBE Online Training is aimed at offering a thorough knowledge of this core banking solution. The following are the major topics covered in the course:

1. Introduction to Oracle FLEXCUBE

Overview of FLEXCUBE and its architecture

Key functionalities and features

FLEXCUBE versions and industry adoption

2. Core Banking Operations

Customer account creation and management

Deposits, loans, and lending process

Fund transfers and payments

Interest, charges, and fee management

3. Retail & Corporate Banking

Retail banking workflows

Corporate banking processes

Trade finance and treasury operations

Wealth and asset management

4. FLEXCUBE Digital Banking

Internet and mobile banking solutions

Omni-channel banking experience

Customer onboarding and self-service

5. Risk & Compliance Management

Regulatory compliance and reporting

Fraud detection and risk mitigation

KYC (Know Your Customer) and AML (Anti-Money Laundering) integration

6. FLEXCUBE Technical & Customization

FLEXCUBE database and architecture

APIs and system integrations

Customization and configuration

Troubleshooting and issue resolution

7. FLEXCUBE Implementation & Administration

FLEXCUBE installation and setup

User roles and access management

Performance monitoring and maintenance

Why Choose ProExcellency for Oracle FLEXCUBE Online Training?

ProExcellency provides top-rated Oracle FLEXCUBE training that enables you to become an expert in core banking technology. Here's why we are the best choice:

Expert-Led Training – Learn from certified experts with hands-on FLEXCUBE experience.

In-Depth Course Content – Core banking, retail & corporate banking, digital banking, risk management, and technical customization.

Hands-on Learning – Real-world exercises, live case studies, and live demonstrations.

Flexible Online Training – Instructor-led or self-directed sessions to accommodate your schedule.

Access to Recorded Sessions – View sessions anytime for improved understanding.

Certification Assistance – Get prepared for Oracle FLEXCUBE certification.

Job-Oriented Training – Acquire industry best practices and career advice.

0 notes

Text

Oracle FLEXCUBE Online Training: A Complete Guide

Introduction to Oracle FLEXCUBE

Oracle FLEXCUBE Online Training Top of Banglore 2025 is a comprehensive core banking solution used by financial institutions worldwide to streamline banking operations, improve customer service, and enhance regulatory compliance. It provides an integrated platform for retail, corporate, investment, and Islamic banking. FLEXCUBE’s powerful automation and real-time processing capabilities enable banks to manage accounts, transactions, risk, and compliance efficiently.

With the increasing demand for skilled professionals in banking technology, Oracle FLEXCUBE Online Training has become a popular choice for individuals and banking professionals looking to upgrade their knowledge. This training helps participants gain expertise in implementing, managing, and customizing FLEXCUBE to meet business needs.

Why Choose Oracle FLEXCUBE Online Training?

Online training offers numerous advantages, making it a preferred mode of learning for professionals and beginners alike. Some key benefits include:

Flexible Learning Schedule – Online training allows participants to learn at their own pace without affecting their work commitments.

Expert-Led Sessions – Courses are conducted by industry experts with hands-on experience in banking and Oracle FLEXCUBE.

Practical Hands-on Experience – Training includes live demonstrations, real-world case studies, and hands-on exercises in a simulated environment.

Certification Preparation – Many courses prepare students for Oracle FLEXCUBE certification exams, increasing job opportunities.

Cost-Effective Learning – Online training eliminates travel and accommodation costs associated with traditional classroom training.

Key Topics Covered in Oracle FLEXCUBE Online Training

1. Introduction to Oracle FLEXCUBE

Overview of core banking solutions

Architecture and components of FLEXCUBE

Understanding banking workflows and processes

2. FLEXCUBE Functional Modules

Customer Management – Creating and managing customer profiles, account types, and banking relationships.

Deposits and Loans – Configuring savings accounts, fixed deposits, loans, and overdrafts.

Payments and Settlements – Processing funds transfers, SWIFT payments, and remittances.

Trade Finance – Managing letters of credit, guarantees, and trade transactions.

Risk and Compliance – Implementing AML (Anti-Money Laundering) and KYC (Know Your Customer) policies.

3. FLEXCUBE Technical Configuration

System setup and user management

Parameter configuration and workflow customization

Integration with external banking applications

4. Reporting and Analytics

Generating financial and compliance reports

Analyzing customer data for business insights

Automating regulatory reporting requirements

5. FLEXCUBE Implementation and Customization

Deployment models: On-premise vs. cloud

Customizing FLEXCUBE to meet specific business requirements

Testing and troubleshooting FLEXCUBE configurations

Who Should Enroll in FLEXCUBE Online Training?

This training is suitable for:

Banking Professionals – Employees working in financial institutions who want to enhance their technical and functional understanding of FLEXCUBE.

IT Professionals – Developers, system administrators, and consultants involved in banking technology projects.

Business Analysts – Individuals responsible for banking process optimization and digital transformation initiatives.

Students and Fresh Graduates – Those looking to build a career in banking IT and financial software solutions.

Career Opportunities After Oracle FLEXCUBE Training

Completing Oracle FLEXCUBE training opens up numerous job opportunities in the banking and financial services industry. Some potential career roles include:

FLEXCUBE Functional Consultant

Core Banking Solution Architect

FLEXCUBE Technical Consultant

Business Analyst – Banking Technology

Oracle FLEXCUBE Developer

System Administrator – Core Banking

With the widespread adoption of FLEXCUBE by banks and financial institutions globally, certified professionals are in high demand.

Choosing the Right Oracle FLEXCUBE Online Training Provider

When selecting an online training program, consider the following factors:

Trainer Expertise – Ensure that the instructors have real-world experience with Oracle FLEXCUBE implementation and customization.

Course Curriculum – Check if the course covers both functional and technical aspects of FLEXCUBE.

Hands-on Practice – Look for training that includes access to a FLEXCUBE sandbox environment for practical exercises.

Certification Guidance – If certification is a goal, choose a provider that offers exam preparation support.

Student Support – Ensure the training provider offers post-training support, discussion forums, and mentorship.

Conclusion

Oracle FLEXCUBE Online Training is an excellent investment for professionals looking to enhance their expertise in banking technology. With a structured curriculum covering key functional and technical aspects, this training equips learners with the knowledge to implement, configure, and manage FLEXCUBE solutions effectively. Whether you are a banking professional, IT consultant, or student aspiring to enter the financial services industry, FLEXCUBE training can significantly boost your career prospects.

By enrolling in a reputable online training program, you can gain the skills required to work with Oracle FLEXCUBE, stay ahead in the competitive job market, and contribute to the digital transformation of the banking sector.

0 notes

Text

Oracle Flexcube: A Comprehensive Examination of its Role in Automation Solutions

Oracle Flexcube is an integrated, enterprise-wide software that provides a single platform for all financial product processing activities by providing centralize data management and enhanced automation workflow processes. In this article, we'll take a closer look at how Oracle FlexCube can be used to streamline enterprise operations across the entire organization.

Oracle Flexcube is designed to provide users with an end-to-end platform that simplifies financial product processing and increases operational efficiency of the customer-centric services. The software offers features such as one view reporting, dynamic business rule creation engine, personalized dashboard designer, maximum utilization of existing resources and extensive support for multiple languages. It also integrates with a variety of existing solutions provided by Oracle to automate activities that are necessary to effectively run the business.

These features give organizations the tools they need to efficiently manage customer relationships and transactions on a wide range of devices including web-based applications and mobile phones. With Flexcube’s data integration technology, organizations can access their customer information from any location without additional hardware or IT infrastructure investments. This helps them increase their performance in customer service as well as reduce IT costs associated with manual data entry tasks.

Flexcube also provides advanced analytics capabilities which enable businesses to gain insights into customer behaviors and interactions through data analytics tools such as machine learning algorithms and natural language processing (NLP) technology. By leveraging these technologies businesses can ensure that customers receive better services in both online and offline channels; this leads to a higher level of satisfaction among clients who actively participate in the process through self-service options or real-time interactions with support representatives via chatbot conversations or virtual assistants.

With its advanced analytics capabilities, businesses can use Flexcube not only for automation but also for predictive scenarios such as market segmentation or proactive marketing campaigns which can help enterprises stay ahead of the competition by recognizing market changes earlier than its rivals do. Ultimately, Oracle Flexcube has become an increasingly valuable tool for organizations looking for optimized solutions within increasingly demanding industries such as banking & finance, insurance & healthcare, or retail & logistics due its capability to integrate easily with enterprise systems while providing robust data management capabilities across multiple dimensions including customers, accounts/transactions., products portfolios & markets served.

#RPA software#RTA software#RMA software#EOD process#Banking and financial Automation#Oracle Flexcube Automation#Insurance automation#Healthcare automation#IT and Consultancy services automation#Intelligent Document Processing#Banking and financial services#IT and Consultancy services#iBorg automation#iBorg automation tool#all in one hybrid automation tool#iBorg hybrid automation tool#Automation Tool#Automation Software#Robotic Process Automation#Robotic Test Automation#Robotic Mobile Automation#Intelligent Process Documentation#Oracle flexcube#automation solution#robotic automation#Banking software

0 notes

Photo

Best Oracle Flexcube core banking services in India

Sirma Business Consulting in India has made significant Research and devised effective solutions for major issues faced by the reputed Banking Agencies. Their technical guidance benefits the Flexcube Banks, by improvising their operational efficiency along with time and cost conservative services.

Sirma Business Consulting service’s main objective is to root out the Complexity in Banking Technology, thus enabling the banks to aim at ensuring the Customer Delightful Banking Experience. Sirma furnishes the wide range of Consulting, Testing, RPA, and Managed Service Offerings which would favor the banking agencies to reach the pinnacle among the cutting-edge technologies.

You would be overwhelmed and highly beneficial as Sirma also serves as an Oracle to Gold partners in which we would guide you with authoritative advice and provide expert solutions too.

#Oracle Flexcube core banking#Flexcube banking software#Digital banking solutions#core banking software services#business intelligence in banking#Robotic Process Automation#Test Automation#oracle Flexcube service company

0 notes

Text

WHY DO WE NEED RPA IN BANKING?

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

Robotic Process Automation (RPA) is a form of business process automation that allows anyone to define a set of instructions for a robot or ‘bot’ to perform. In other words, RPA is an application of technology, governed by business logic and structured inputs, aimed at automating business processes. Using RPA tools, an organization can configure software, or a “robot,” to capture and interpret applications for processing a transaction, manipulating data, triggering responses, and communicating with other digital systems and many more.

What is IMPACTO iBorg?

“IBorg” is an “Intelligent RPA tool” from IMPACTO which makes use of Artificial Intelligence and Machine Intelligence to help business operations with getting increasingly nimble and practical through automation and rule-based back dull office processes. It permits clients to use similar automation situations for the lifecycle of the considerable number of applications utilized for their business processes. With IBorg, clients approach a single platform to serve the automation needs of their company, development, and operations teams.

WHY CHOOSE SIRMA BANKING SERVICES?

Sirma India spends lot of efforts in Research & Development and has developed effort effective solutions which brings in not only saving cost and time for Flexcube Banks, but also provides effective solutions that improves operational efficiency. At Sirma we believe we are the extended arm of the institution and it our responsibility to take the complexity out of banking technology, so banks can focus on providing what they are for: ''Customer Delightful banking experience”. Sirma offers a range of Consulting, testing, RPA and Managed service offerings which will help banks stay on top of the cutting-edge technologies. Being Oracle go to Gold Partner provides you with the confidence that you are dealing with an authority when it comes to Oracle enterprise solutions and services.

Sirma Business Consultancy has been chosen as The Best Banking Technology Provider as we always try to reach the peak where we make lives simpler by using our technology. Sirma Business Consulting provides the best services around Oracle Flexcube for Core banking implementation, Testing, customizations, managed services and various other Flexcube services for banking & financial services, insurance, Credit unions, Cooperative societies and so on.

#oracleflexcube#robotic process automation#flexcube upgrade#test automation#banking software#digital banking#rpa robotic process automation

1 note

·

View note

Text

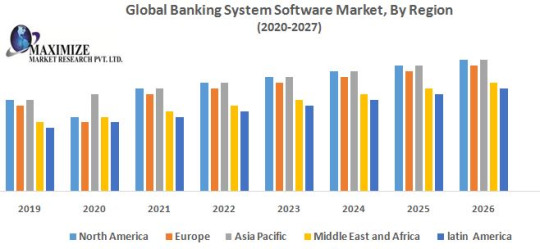

Global Banking System Software Market : Industry Analysis and Forecast (2019-2026) – by Type, Application,Core Banking Software, Features of core banking software,and Region

Global Banking System Software Market size was US$ 26.71 Bn in 2019 and expected to reach US$ XX Bn by 2026, at a CAGR of XX % during forecast period.

The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.

Banking system software market is segmented by type, application, and region. On basis of type banking system software market is segmented into core banking software, multi-channel banking software, bi software, and private wealth management software. Application segment is divided by risk management, information security, business intelligence, training and consulting solutions. Geographically, banking system software market is spread by North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Increasing implementation of online banking and mobile banking by customers which appearances high level of inclination towards accessing their account details and perform financial actions by digital platform driving the demands for banking system software .Customer can use their laptops, smartphones, tablets and emerging trends such as patch management is expected to provide numerous opportunities banking system software market growth. Banking system software market is driven by rising necessity to increase productivity and operational efficiency of banking industry. Furthermore, Concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market.

Mobile Terminal Segment represented the major share in the global banking system software market owing to its high prevalence in the global market. The increase in cell phone purchasers has basically determined the market for mobile banking software. Advances in digital technology has offered countless of channels for customer interaction. Customer interaction via digital channels is generating beneficial transactional data. Mobile banking has been increasing with the growing number of smartphone owners with a bank account.

North America is projected to be the dominant region on account of the prevalent banking sector and high attentiveness of online banking. North America Market is followed by Asia-Pacific mainly on a result of the government initiatives in the banking industry. Remarkable demand is witnessed by developing nations such as India and China are accounted development of private and rural banking.

Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited., Infosys Limited, Capgemini, Accenture., NetSuite Inc., and Deltek, Inc., Millennium Information Solution Ltd., Strategic Information Technology Ltd., Aspekt, Automated Workflow Pvt. Ltd, Canopus EpaySuite, Cashbook, CoBIS Microfinance Software, Probanx Information Systems, Megasol Technologies, EBANQ Holdings BV, Kapowai, Crystal Clear Software Ltd., Infrasoft Technologies Ltd., Misys, Banking.Systems, ABBA d.o.o., SecurePaymentz, TEMENOS Headquarters SA.

The objective of the report is to present comprehensive analysis of Global Banking System Software Market including all the stakeholders of the industry. The past and current status of the industry with forecasted Market size and trends are presented in the report with analysis of complicated data in simple language. The report covers all the aspects of industry with dedicated study of key players that includes Market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give clear futuristic view of the industry to the decision makers.

The report also helps in understanding Global Banking System Software Market dynamics, structure by analyzing the Market segments, and project the Global Banking System Software Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Banking System Software Market the report investor’s guide.

Global Banking System Software Market Request For View Sample Report Page :@https://www.maximizemarketresearch.com/request-sample/16011

The scope of Global Banking System Software Market

Global Banking System Software Market, by Type

• Windows • Android • iOS

Global Banking System Software Market , by Core Banking Software • Temenos Core Banking • MX for Banking • Oracle FLEXCUBE • Plaid • Q2ebanking • Others Global Banking System Software Market , by Features of core banking software

• Others Recording of transactions • Passbook maintenance • Interest calculations on loans and deposits • Customer records • Balance of payments and withdrawal • Others Global Banking System Software Market, by Application

• Risk management • Information security • Business intelligence • Training and consulting solutions Global Banking System Software Market, by Geography

• North America • Europe • Asia Pacific • Middle East & Africa • Latin America Key Players Global Banking System Software Market

• Microsoft Corporation • IBM Corporation • Oracle Corporation • SAP SE • Tata Consultancy Services Limited. • Infosys Limited • Capgemini • Accenture. • NetSuite Inc. • Deltek, Inc. • Millennium Information Solution Ltd. • Strategic Information Technology Ltd. • Aspekt • Automated Workflow Pvt. Ltd • Canopus EpaySuite • Cashbook • CoBIS Microfinance Software • Probanx Information Systems • Megasol Technologies • EBANQ Holdings BV • Kapowai • Crystal Clear Software Ltd. • Infrasoft Technologies Ltd. • Misys • Banking.Systems • ABBA d.o.o. • SecurePaymentz • TEMENOS Headquarters SA

Global Banking System Software Market Do Inquiry Before Purchasing Report Here @ :https://www.maximizemarketresearch.com/inquiry-before-buying/16011

About Us:

Maximize Market Research provides B2B and B2C market research on 20,000 high growth emerging technologies & opportunities in Chemical, Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.

Contact info: Name: Vikas Godage Organization: MAXIMIZE MARKET RESEARCH PVT. LTD. Email: [email protected] Contact: +919607065656 / +919607195908 Website:www.maximizemarketresearch.com

0 notes

Text

Oracle Blockchain ‘Extends Boundaries of the Enterprise’

Oracle Blockchain Cloud Service can help companies reduce friction in business-to-business transactions by eliminating the need for third-party intermediaries, says Mark Rakhmilevich, Oracle senior director of product management and strategy.

Oracle Blockchain Cloud Service provides preassembled blockchain code that’s optimized for many standard business processes, including ERP transactions that traditionally require third-party validation. Blockchain addresses the problem of trust between organizations by providing independent validation through a tamper-resistant, peer-distributed ledger, thus eliminating the need for offline reconciliation. “Blockchain can remove the need for intermediaries and replace it with cryptographically secure protocols,” Rakhmilevich said during a presentation this week at Oracle OpenWorld 2017. “It will help companies extend the boundaries of their enterprises.”

Related: Learn more about Oracle Blockchain Cloud Service

He noted that the service is provided as a managed platform as a service so companies “don’t have to stand up new instances for every use case.” In this preassembled service, “all needed components have been provisioned.”

Oracle Blockchain Cloud Service enables customers to:

Deliver business results with the ability to rapidly onboard and easily scale the network participants globally, while helping ensure that operations run continually with resilience, high availability, and autonomous recoverability.

Accelerate innovation with Oracle Cloud applications by extending enterprise boundaries to reduce friction in existing business processes and enable new business models and opportunity to access untapped revenue streams. The Applications Integration toolkit provides integrated applications, sample code, templates, and design patterns to accelerate the integration of blockchain applications to Oracle SaaS and on-premises applications suites.

Speed up business processes through trusted real-time information sharing across existing Oracle ERP Cloud, Oracle SCM Cloud, Netsuite SuiteCloud Platform, or custom blockchain application integrations.

Reduce risk, complexity, and increase efficiency by securely automating cross-organization transactions, and providing reliable sharing of information both inside and outside the enterprise boundary. Combined, these can help reduce transaction costs, mitigate security and privacy risks for enterprises, and simplify compliance and audits. With a preassembled, managed cloud platform, customers can also simplify operational complexity, dynamically change network configurations and rapidly identify and resolve issues with real-time monitoring dashboards. Furthermore, as blockchain technology rapidly evolves, Oracle stays on top of the latest capabilities and helps ensure customers are not exposed to undue risk of technological churn.

Accelerate time to market with REST API-driven platform and rich integration options in Oracle Cloud Platform. Start developing blockchain applications within minutes without complex setup and provisioning, and leverage API-driven development for cloud or on-premises applications using REST API and API management service to easily invoke blockchain services directly or with prebuilt integrations from Oracle Cloud.

Additionally, Oracle Blockchain Cloud Service will be offered as part of Oracle Platform for Open Banking and will provide seamless connectivity between Oracle FLEXCUBE and other banks to enable greater security, scalability, and transparency in the information exchanged. https://blogs.oracle.com/oracle-blockchain-cloud-service-%E2%80%98extends-boundaries-of-the-enterprise%E2%80%99

from WordPress https://reviewandbonuss.wordpress.com/2017/10/04/oracle-blockchain-extends-boundaries-of-the-enterprise/

0 notes

Text

Advantage of automation tools instead of a manual approach

Using automated software testing tools can help to speed up the testing process, while providing more accurate and consistent results. Automated tools can also help to identify and eliminate errors more quickly than manual testing, as well as test larger sets of data and data combinations than would be possible with manual testing. In addition, automation tools can be used to repeat tests quickly and easily, allowing for a much faster feedback loop when making changes or improvements to the software. Finally, automated tools can help to reduce the costs associated with manual testing by eliminating the need for manual labor.

#robotic test automation#robotic process automation#automation software#automation in banks#automation#innovation#flexcube bank#iborg#oracle flexcube#banking software#automation solution#robotic automation#automation services

0 notes

Text

What iBorg can Offer ?

The artificial intelligence and machine learning capabilities of iBorg will enable autonomous operational capabilities, freeing employees from repetitive tasks and allowing them to perform more meaningful work. It can operate on a variety of devices, including desktop applications, AS400 screens, multiple web browsers, headless browsers, tablets, and mobile devices.

iBorg provides a comprehensive suite of services that help businesses improve their decision-making processes by providing accurate, reliable information.

iBorg is a leading-edge application for automating business processes and solutions. iBorg is specially developed for the banking and the financial industry with a broader test coverage across multiple systems. Our USP is our one-stop automation tool with additional add-ins and screen recorder with ultimate goal of achieving perfection in automation.

Totally non-invasive automation

Platform agnostic

End to end automation

Communicate with bank users through emails, SMS and WhatsApp

iBorg assists you to implement dependable, cost-effective automation solutions to maximize efficiency for business intelligence data, thereby increasing overall productivity and enhancing user experience by leveraging the power of an exceptional digital transformation.

#robotic process automation#workflow automation#automation services#automation software#oracle flexcube#robotic test automation#robotic mobile automation#automation in banks#automation solution#robotic automation#Banking software#flexcube bank#iBorg#iBorg INC#automation solutions#machine learning#artificial intelligence#digital transformation

1 note

·

View note

Text

Introducing iBorg INC

iBorg Inc is a new-generation automation enterprise set up in Delaware, USA. iBorg is a low-coded automation tool that provides Robotic Process Automation , Robotic Mobile Automation , and Robotic Test Automation using AI and ML technologies in one. iBorg Inc aims to "Make Automation Simple and Accessible for Everyone".

#robotic process automation#workflow automation#automation services#automation software#oracle flexcube#robotic test automation#robotic mobile automation#automation in banks#automation solution#robotic automation#Banking software#flexcube bank#iBorg#IiBorg INC

1 note

·

View note

Text

BENEFITS AND FEATURES OF FLEXCUBE CORE BANKING SYSTEMS

What is core banking?

Core banking is defined as a back-end system that processes banking transactions across the various branches of a bank. Core banking systems processes and services include servicing loans, calculating interests, processing deposits credit processing, and customer related management.

What is Flexcube?

FLEXCUBE is developed and introduced by oracle financial services, it is an automated universal core banking software that is designed as a solution for financial organizations and banks.

What are the Companies that have Oracle Core Banking Systems?

PNC: PNC offers a wide range of services for all our customers, from individuals and small businesses, to corporations and government entities. It uses Flexcube Core Banking system to provide efficient services to its clients

CITI BANK: Citi India's products and services are organized under two major segments: Institutional Clients Group (ICG) and Global Consumer Bank (GCB).

WELLS FARGO: The name Wells Fargo is forever linked with the image of a six-horse stagecoach thundering across the American West, loaded with gold. It is today a known user of Flexcube Core Banking System.

SVB BANK: For over 35 years, SVB has helped businesses grow and thrive across the innovation economy. It has worked hard and today it is known among the Top Banks in the world. It too uses Oracle Flexcube for Core banking system for implementation of Banking Services.

SIRMA BUSINESS CONSULTANCY: Sirma Business Consulting is an Oracle Flexcube Gold Partner that provides services around Oracle Flexcube for Core banking system and implementation, Testing, customizations, and managed

Features of Oracle Core Banking System

Responsive UI

Personalized UX

Core functionalities for a traditional and non-traditional banking

Machine Learning

Blockchain

Data privacy and regulatory compliance

Biometric face recognition

Multi-language, multi-currency, multi-entity operations

Security management covering application and role-based access

Online validations and automated exception processing

Centralized, decentralized, and combination deployments

Benefits of Oracle Core Banking system

Enable up-selling and cross-selling through intelligent dashboards

Monitor, manage and regulate processes, compliance, and reporting

Deliver product extensibility and increase flexibility and interoperability

Replace legacy systems with a universal solution.

Get a holistic view of customers.

Integrate with other applications.

Move to the centralized processing of big data.

Use analytical tools to evaluate customer needs in new products and services.

Provide high-level customer support.

Processes large transaction volumes round the clock

Supports multiple channels and interfaces

Ensures security across application and systems with role-based access

Leverages its service-oriented architecture to support agile business process management

Uses components-based architecture to build scalable and reusable solutions

Highlights of Oracle Flexcube Core Banking System

Drives enhanced customer engagement and value with next-generation digital capabilities and user experiences

Improves insight generation and enhances straight-through processing with intelligent decision-making and automation using technologies like machine learning and natural language processing

Enables rapid and secure integration and collaboration with third-party firms and ecosystems through externalized business services and an open architecture

Supports multiple deployment options across on premises and cloud and multiple deployment models

CONCLUSION

Oracle Flexcube Core banking system benefits a lot of companies with its easy and modern banking solution that helps growing companies.

0 notes

Text

TOP 5 RECOGNIZED ORACLE FLEXCUBE IMPLEMENTATION PARTNERS IN BANGALORE

Who introduced FLEXCUBE?

FLEXCUBE is an automated complete core banking software introduced by Oracle Financial Services Ltd. Oracle FLEXCUBE Core Banking Solution offers a unified central flexible understanding that meets the modern necessities of a Bank. It offers customer-based or customer-driven core banking functionalities and ensures and considers the complete opinion of all customers. It also augments the link between bank employees and consumers.

What is the Flexcube Implementation process?

STEP 1: Installation of Oracle Flexcube Universal Banking Solutions

STEP 2: Parameterization of individual modules with particular requirements

STEP 3: Migration from Legacy System to Oracle Flexcube Universal Banking system

STEP 4: Integration of third-party system

STEP 5: Addition of other capabilities like the transactional system and so on.

Who Are The Top 5 Partners of Oracle Flexcube?

1. JMR Infotech: JMR Infotech is one of Oracle’s earliest Platinum Partners in the BFSI space, globally. JMR is now recognized as one of the Important Technology Services companies that concentrate on Digital Transformation for Financial Services. Being a platinum partner, it is one of the Oracle Flexcube Implementation Partner located in Bangalore. JMR revolves its services around providing- Financial Services and Solutions, Digital and Enterprise solutions, and JMR Digital Platforms.

2. FINONYX: Finonyx Software Solutions has its delivery and development hub based out of Bangalore, India, and Subsidiary Office in Dubai, United Arab Emirates. Finonyx is an Oracle Platinum Partner that is focussed on providing services around Oracle financial Services. Focused on IT solutions and application development services for banks and financial institutions across the globe, Finonyx Software Solutions is a trusted Oracle Flexcube Implementation Partner as a Platinum member providing complete consulting, testing, and implementation services for the Oracle FLEXCUBE suite of products.

The services provided by Finonyx are:

Core Banking Transformation

Digital Transformation

Managed Services

Governance Risk & Compliance (GRC) Consulting

Infrastructure Transformation

Custom Development Service

3. TREMPPLIN INFOTECH: Trempplin is an Oracle Gold Partner focused in Oracle FLEXCUBE Implementation, Upgrades, Support, Training, and IT Staff Augmentation Services specializing in Financial Industry. Being an Oracle Flexcube Implementation Partner in Banking and Financial Domain, it provides the following services:

Testing Services

Consulting Management Services

Training services

Application Development

BAU Support

Staffing Services

The Solutions provided by Trempplin are:

Oracle FLEXCUBE Solution

OBDX (Oracle Banking Digital Experience)

Oracle Financial Services Analytical Application (OFSAA)

Digital Marketing

E-Learning Portal

Digitalization of sop’s in Banks

Web Technology

4 SIRMA BUSINESS CONSULTING: Sirma Business Consulting (India) Private Limited has been established in 2015 and is based out of Bangalore. Sirma provides Banking and Financial services that bridge the technology gap with its client-specific and process-oriented approach to transform business digitally. Sirma Business Consulting is an Oracle Flexcube Implementation Partner that provides services around Oracle Flexcube for Core banking implementation, Testing, customizations, Managed services, and various other Flexcube services for banking & financial services, and insurance. Sirma offers a range of Consulting, Testing, RPA, and Managed services which will help banks stay updated with modern technologies. Sirma is an Oracle Gold Partner that provides a range of services such as: https://www.sirmaglobal.com/about-us-flexcube-core-banking-solutions.html

Oracle Flexcube services

Managed Services

Business Intelligence & Data warehousing

Penetration Testing and Ethical Hacking

Testing Centre of Excellence

DataBase Tunning

Business Process Reengineering

Business Intelligence & analytics

Application Development & Maintenance

Database Activity Monitoring

Performance Tuning Services

Database Management Services

IT managed services

Sirma with its 100+ man-years of experience in implementing Oracle Financial Software Services’ banking products (Oracle FLEXCUBE UBS & Oracle Flexcube Investor Servicing), brings in industries’ best practices and process-oriented approach which makes the implementation process or Managed services easy. Sirma also has a suite of products “ImpactoXgen”. It includes Team Zoid, Trainz, Ambassador Banking, and iBORG. Sirma has also been awarded by CIO Awards as “10 Most Promising Banking Technology Service Providers 2019”.

5. Profinch is established in Bangalore to deliver a complete Banking experience to its customers. Profinch believes in providing a complete 360 Transformation of the Bank. The services it provides are:

Core Banking

Oracle Banking Digital Experience (OBDX)

Oracle Financial Services Analytical Applications (OFSAA)

Infrastructure Services

Digital Transformation

Reporting and Big Data Analytics

Managed Services

Profinch is one of the Oracle Flexcube Implementation Partner. It has two main products- Fincluez Data Hub and Finflowz Digitalization Hub.

What Benefits do Oracle Flexcube Partners get?

Fast implementation of innovation

Increased transaction security

Multidimensional agility

Enhanced connectivity

Reduced risk and improved regulatory compliance.

Reduced operational costs and optimal efficiency

Conclusion

FLEXCUBE Core Banking is planned to revolutionize a bank’s core systems professionally and transmute the bank to a digital connected bank of tomorrow. Being an Oracle Flexcube Implementation Partner is highly beneficial. It helps in the growth and development of the companies. There are many such partners and systems that support Flexcube.

Hope this article was helpful. Please let us know in the comment section below!

0 notes

Text

Oracle FLEXCUBE: A complete trusted Banking Solution

What is Oracle FLEXCUBE?

Oracle FLEXCUBE helps transform financial institutions by aiding them in digitizing their business and building customer intimacy by providing efficient service and overcoming competition. It drives the customers to experience the next generation of banking with digital capabilities and supports for corporate, investment banking, retail banking, etc. Oracle FLEXCUBE core banking solution offers a seamless centralized and versatile expertise that meets the necessities of a bank. Oracle FLEXCUBE is a complete and comprehensive package of banking applications and cutting edge technologies that meet any businesses IT and business requirements.

Oracle FLEXCUBE features:

The major Oracle FLEXCUBE features follows,

1. Biometric face recognition: The use of face recognition helps the manager to authenticate the user lockers.

2. Data Privacy: Data privacy is important in banking. It concerns the customer sensitive information. It verifies the identities and allows access to an account.

3. Support for multiple deployment: This supports deployment options and strategies according to specific banks where they can jumpstart and accelerate with capabilities of staying active and helps to resolve the complaints in a fast evolving technique.

4. Machine learning: The Safe bank transactions. The system constantly keeps on learning in the context of fraud prevention which proves to be helpful for carrying out processes in a well ordered fashion.

What does Oracle FLEXCUBE Offer??

Oracle FLEXCUBE aids in digital engagement among the banks to transform and improve the product experience and services. Oracle FLEXCUBE helps deepen customer relationships and gives higher gains.

✔ FLEXCUBE offers to enrich the customer guidance and advise the product process with the latest technologies.

✔ Oracle FLEXCUBE offers personalized user experience and on demand.

✔ It adopts a multi-dimensional design process to generate a complete digital transformation for an individual to view anytime and anywhere and empowers customers.

✔ Oracle FLEXCUBE enables banks to process automation with use cases and drives more engagement among customers.

✔ Oracle FLEXCUBE offers Machine learning which moves from any data source to integrate with other applications.

Key benefits of Sirma Business Consulting in Digital Engagement with Oracle FLEXCUBE Banking:

* We believe Sirma accelerates with higher efficiency and levels to grow through the customer network.

* Sirma has a great connection with real time customers and provides banking work with digital players in improving orderly environment and static innovation.

* It enables for open banking and finance and focuses on connection that drives productivity.

* Supports to help in protection of privacy and security with fully digital banking transformation.

* Sirma helps banks transform the new products and service development of high levels to process flow of rapid systems.

Let’s connect @ https://sirmaglobal.com/

0 notes